2021 FMCG B2B eCommerce Benchmarking Report

December 8, 2021 By Yana Persky

To understand the state of the FMCG B2B eCommerce market, where it’s headed, and what drives CPG wholesalers and distributors to adopt omnichannel commerce, we surveyed 200 Pepperi prospects during 2021.

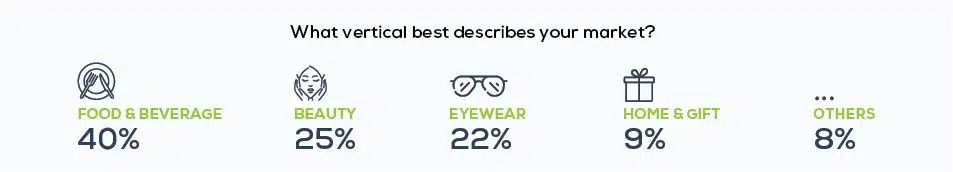

Demographics

Respondents included CPG wholesalers and distributors across 3 regions including the US (106 respondents), EMEA (62) and APAC (32).

Drivers for moving to omnichannel commerce

To understand more about why these changes are taking place, and where omnichannel can support, we took a closer look at the forces behind B2B eCommerce growth.

Over half of those that plan to adopt an omnichannel commerce approach are doing so with an eye on increasing revenues (58%). It goes very much in line with the 2020 Global Benchmark Report revealing that on a global scale, distribution companies experience an annual revenue loss in the range of 7.25% – 28.47% due to sub-par sales practices, and an annual margin loss in the range of 2.89% – 15.70% due to sub-par pricing practices. 53% reported they want to be more competitive in the market (53%), 47% are driven by wanting to satisfy customers and around 18% to increase product discoverability.

“The future of B2B eCommerce for FMCG organizations is bright. There is no going back to offline. As the pace accelerates for B2B e-commerce, the pace also accelerates for the transition to self-distribution as FMCG organizations shift to avoid the squeeze on margins and desire to take control of their supply chain. I expect B2B eCommerce to ramp up as quickly as B2C eCommerce has been ramping up.”

Lisa Anderson, President, LMA Consulting Group, Inc.

Do you currently have a B2B eCommerce site?

Despite the pandemic and the accelerated growth of B2B eCommerce, the majority (55%) of respondents still haven’t implemented a self-service portal.

Which sales channels are you currently using?

Out of three sales channels, telesales and field sales are still the most preferred and widely used channels among wholesalers and distributors across all regions.

What are your top concerns about moving to omnichannel sales?

Adopting an omnichannel approach to sales comes with many concerns. We keep hearing over and over that field sales are hampering B2B eCommerce. The fear of losing jobs due to eCommerce causes a lot of stress – with 72% of respondents stating that the conflict with field sales is inevitable. Despite the benefits seen, over 60% of respondents reported they fear a reduction in the average order size (67%) and scale with existing legacy systems (65%). High costs of customization and support (60%) was another reason not to make the change.

“Include your sales reps in the channel shift process. If it’s in the best interests of the company, because it’s in the best interests of customers, to migrate to automated channels, then it’s going to happen despite objections from internal constituencies. Smart and savvy sales reps know that digital is not their enemy, but their ally. Harnessed properly, digital enablement technologies for sales reps can make those very same sales reps far more productive, and therefore far more successful, than ever before.”

Andy Hoar, Co-Founder, Master B2B Ecommerce

What legacy solutions are you using?

The transition from in-house to commercial B2B eCommerce solutions is on the rise. The percentage of B2B sites using in-house commerce platforms accounts for less than a third (29%) of the market. The capabilities of commercial B2B eCommerce platforms have significantly improved although we see many existing customers of Magento (15%), BigCommerce(7%), SAP Hybris(5%) and Shopify(5%) coming to Pepperi to book demos, get pricing quotes and eventually replace their legacy solutions.

What business models does your company use?

The rise of B2B marketplaces and DTC model have disrupted the traditional B2B value chain, providing a huge drive for B2B sellers to modernize – and fully embrace their digital transformation. With 66% of distributors and 53% of manufacturers losing revenue to marketplaces and the DTC model being not scalable, it’s no wonder the majority of respondents (95%) are sticking with their traditional B2B sales channels, rather than going DTC or selling on marketplaces.

Which B2B features are most critical to you?

According to approximately 90% of respondents, tight integration with their ERP (89%) and a mobile app (85%) were the most critical B2B features.

On top of transferring accounts and product data, CPG brands and wholesale distributors often have complex pricing structures in their backend ERP – with multiple prices, complex promotions and additional surcharges that are unique to each customer, whether through quotes or signed contracts. The difficulty in setting prices increases further if pricing is to be established for customer or purchasing groups and is influenced by order frequency, urgency, product types, payment and delivery terms, warranty and purchase quantity.

We’re seeing an increasing number of FMCG manufacturers and wholesale distributors invest heavily in native B2B eCommerce mobile apps. Having a powerful, dependable, native mobile B2B eCommerce app is no longer an option, but rather a necessity that allows B2B buyers to not only place orders whenever they want, but also to communicate directly with their suppliers.

According to our internal data, native mobile apps handle over 53% of B2B eCommerce transactions, and we expect this number to continue to rise as our clients’ interest in native mobile B2B eCommerce apps grows.

79% of respondents turn to trade promotions to get a competitive advantage in today’s industry. However, it’s important to them to invest in a robust trade promotions solution that enables sales and marketing managers to easily set up a wide variety of promotions using drag and drop, and then push them out to the different sales channels.

Which advanced ERP data do you plan to replicate in B2B eCommerce?

The vast majority of respondents reported that they invest in full-blown ERP systems to provide tight financial and strong inventory control. To operate effectively and productively, it’s important for them to leverage the full scope of their ERP data structure by keeping their inventory levels current (92%), indicating cutoff times (64%), managing promotions (46%), automatically prioritizing the ‘Quantity Available’ field based on pre-defined criteria (28%) and restricting the number of frequently out-of-stock items (24%) and handling multi-warehouse inventory (19%).

Summary

Pepperi’s sales team has been witnessing a significant increase in demand for a B2B eCommerce solution. This makes sense, as eCommerce is quickly becoming the preferred way to keep sales going despite all the concerns listed above. Brands and wholesalers realize they benefit greatly from strong B2B eCommerce capabilities and are willing to invest in a B2B sales platform that will give them flexibility and allow them to easily make adjustments to fit their changing business needs.

“The future of B2B eCommerce for FMCG organizations is about connecting channels and facilitating ecosystem growth and relevancy. All brands sell through multiple touchpoints because customers interact with brands through multiple touchpoints. If your brand has partner wholesalers, resellers and distributors, then sooner or later you’re going to need to digitize how you merchandise and transact via them. In a phrase, that’s B2B eCommerce.”