Will Direct-to-Consumer Put Tier 2 Wine Wholesalers at Risk?

March 31, 2021 By Yana Persky

The US has one of the most complicated and highly regulated systems of alcohol sales in the world. Under the three-tier system, manufacturers (Tier 1) sell alcoholic beverages to licensed importers or wholesalers (Tier 2), who distribute the products to retailers (Tier 3), who sell both to the on-premise (e.g. bars) and off-premise (e.g. liquor store) consumers. No one entity can be involved in more than one tier, and each tier is regulated and licensed separately.

And talking about regulations, each state determines how to handle its own alcohol sales, which creates huge disparities in wine and spirit selection, availability and pricing. Each state is different and has a long list of complicated requirements to comply with before the distribution and sale of alcoholic beverages in any state. Instead of a single market, the United States functions like 50 different countries!

For example, only 10 states and the District of Columbia support direct-to-consumer shipping of beer to the residents of Alaska, Kentucky, Nebraska, Nevada, New Hampshire, North Dakota, Ohio, Oregon, Vermont and Virginia. And just 7 states (Alaska, Arizona, Kentucky, Nebraska, Nevada, New Hampshire and North Dakota) and the District of Columbia are among those that allow D2C shipment of spirits.

Direct-to-Consumer (D2C) Model

Alternatively, any winery can sell their wines using the direct-to-consumer (D2C) model that was adopted several decades ago. There are more than 400K alcohol labels approved for sale in the United States, yet in most states, wholesalers offer between 40-60K products combined. The reason for such a relatively small product selection is the wholesaler’s unwillingness to buy from small and medium sized wine producers. On the contrary, large wine producers and those that were lucky enough to convince wholesalers to work with them, derive 60-80% of their income through 3-tier distribution.

The direct distribution model was aimed at assisting small and medium-sized wine producers to sell directly to customers without ‘begging’ a wholesaler, but only in states where their license permits.

Covid-19 Impact on Wine Producers

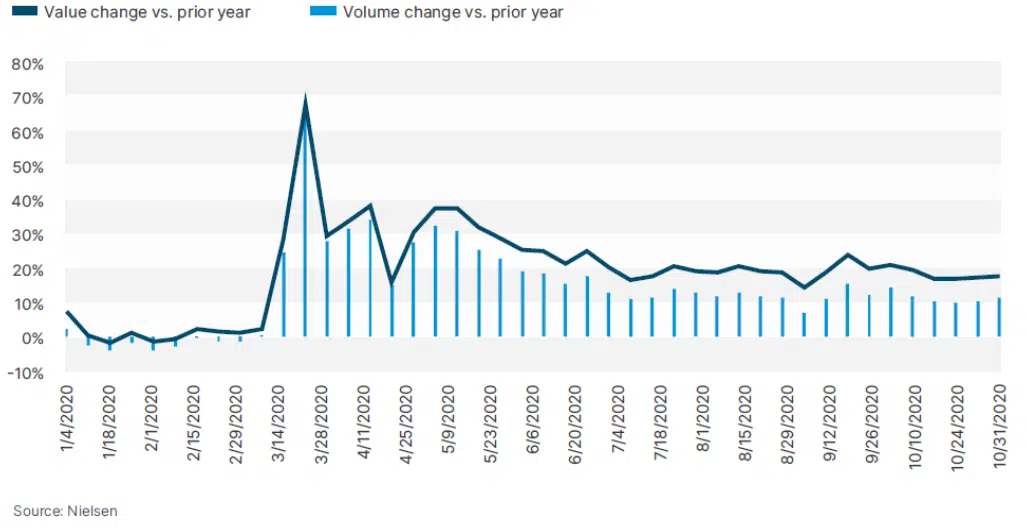

The closures of bars and restaurants during the Coronavirus lockdowns, resulted in a massive shift from on-premise to off-premise alcohol consumption. As off-premise customers were stockpiling, the volumes surged. There is no doubt that this new situation created new sales opportunities for large and small producers alike.

Off-premise volume and value changes in 2020 vs. prior year

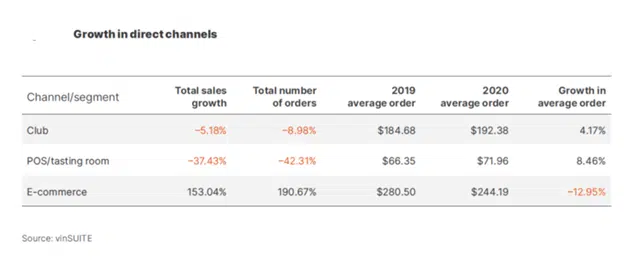

The small wine producer has experienced 153% growth in online sales last year with an average order 300% larger than the average order in the tasting room.

Covid-19 Impact on Wine Wholesalers

At the wholesale level, the shift to off-premise led to an unprecedented sales growth through grocery sales and the operations required repositioning of existing on-premise stocks into off-premise that could cover the high shortage in wine. With too much activity going on and too many logistical problems, wholesalers had to change their operations to think very fast. Every day, every week brought a different dynamic.

The traditional sales channels used by wholesale distributors have been severely impacted. Even though online B2B operations became a major focus amid the pandemic, many wholesalers found themselves unprepared to deal with rapid change. To meet high demand in different wine categories, retailers required a convenient online ordering website that would allow them to access the company’s inventory, discover new products and make the process of reordering a breeze.

Covid-19 Impact on Digitization

From a functional and operational perspective, all stakeholders of the three-tier system agree that Covid-19 has led to greater digitization. During lockdown, e-commerce has been one of the preferred channels keeping distributors, retailers and wineries in contact with each other. At the wholesale level, more and more distributors are upgrading and streamlining their operations for the digital age. Southern Glazer’s launched its e-commerce platform in 28 states. Republic National Distributing Company (RNDC) and Breakthru Beverage Group are also investing aggressively in e-Commerce.

It has become evident that investing in B2B e-Commerce has allowed wine distributors to benefit from under-used channels, help them stand out from competition and survive. However, looking to the future, there is a huge difference between just surviving and improving sales. The wine distribution industry comes with a unique set of operational challenges and it is highly recommended to rely on an omnichannel B2B sales platform that would address the wine wholesalers’ challenges below:

- Tracking Wine Rotations

Wine shipments are accompanied by a lot or batch number, usually known as a rotation. Each rotation comes with a series of dates including ‘use by’, ‘best by’ and ‘not before’. Wine distributors need to ensure that inventory is issued to customers in date order – and in the case of a recall, should be able to easily track which customers received which rotation and when. - Duty/Taxation Regulation

To comply with government regulation and taxation, wholesalers need to display duty due and duty free tax at the line-item level to easily track which items, vintage, and lot to move from duty free to duty due for a customer order. - Promotions

Trade promotions have become an essential tool for wine and spirit wholesalers to gain an edge in competitive markets. With dozens or hundreds of promotions running in parallel, it is important to have a configurable tool to easily set up a wide variety of promotions. - Unit of Measure (UOM) Display and Pricing

Wines are typically sold in cases of six bottles, but a single bottle purchase is also common. If a customer wants to purchase 2 cases and 3 bottles, the documentation will likely list a quantity of 2.666 cases instead of a more logical unit of measure as 2/3. Since single bottles can cost more, UOM pricing becomes a real issue and needs to be adjusted and configured accordingly. - Flexible Pricing

The wine wholesaler sector deals with large volumes and complicated transactions. Each customer has their own strictly-negotiated pricing structure based on their individually agreed contract, so their B2B e-Commerce solution must have the ability to accommodate and display the specific terms according to each customer. - Compliance Rules

Sales reps have to follow all rules and regulations, as what is sold at a grocery store vs. liquor store. With so many state-licensing regulations and federal laws, sales reps have to be prepared ahead of customer meetings by having all the rules and regulations for an account in a single view.

Summary

D2C saw a positive gain at the expense of wholesalers amid the Coronavirus pandemic, and could have gained more traction if retailer interstate shipment of wine had been legalized. There is a lot going on behind the scenes and the National Association of Wine Retailers has declared a war on middlemen wholesalers that along with US retailers and alcohol regulators, oppose retailer interstate shipments rules and laws. Will this regulation put wine and spirit wholesalers at risk? It might put smaller ones out of business to some extent, but overall it will be hard to replace them given their scale, the huge investments they make in automating sales and logistics processes, and their ability to effectively streamline operations by connecting the largest wine and spirit producers with the largest retailers.

To find out more about Pepperi, contact us today!