“Buy Now, Pay Later” is Making Inroads into the B2B Ecommerce Space

May 25, 2021 By Yana Persky

We are lucky to witness how innovation is transforming CPG supplier and buyer preferences in every possible domain. Market opportunities and threats materialize in the blink of an eye, whereas B2B buyers expect prompt and flawless responses. Every day, new applications emerge while others become less useful and irrelevant.

High-performing B2B brands and wholesale distributors choose best-of breed 3rd party solutions for their B2B eCommerce tasks, and the number of integrations a typical project may have is no longer an issue. Nobody disputes the fact that best of breed solutions (with their literally endless possibilities) offer more extensive features and functionalities to address a specific B2B eCommerce environment. So compromising for a “good enough” rather than “the best” solution is not an option for fast moving B2B wholesale distributors and brands, and can lead to lost revenues and missed opportunities. But is it possible to have too many of these apps, as fantastic and useful as they are?

Let’s try to address this question by looking at B2B payment solutions.

The excerpt below is taken from communications we had with one of our customers 3 months after we integrated 7 different payment types.

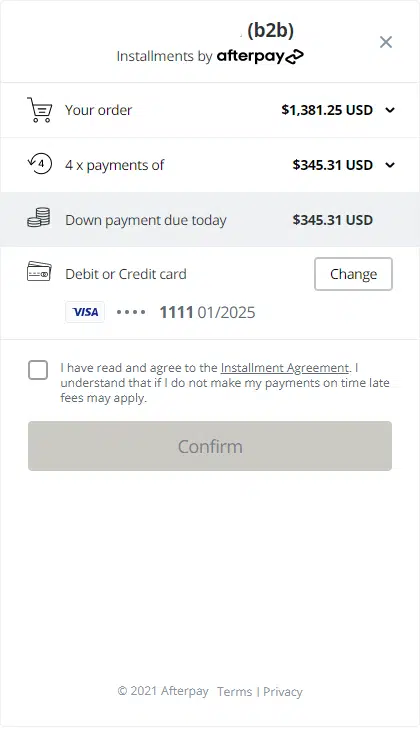

“We have expanded our B2B business to Australia and surprisingly for us Afterpay has become a key payment expectation for many B2B buyers here in Australia. We really need Afterpay integration as soon as possible please, as we are losing customers for not being able to accommodate them!”

Afterpay, best known for its “Buy Now, Pay Later” service lets shoppers buy without paying the full amount upfront and then pay the rest of their balance in monthly, interest-free installments. The BNPL industry is on the rise and is expected to account for 9% of B2C eCommerce spending by 2023.

BNPL platforms such as Afterpay, Splitit, Affirm, Zip Pay and Klarna, have quickly become a popular online payment option among B2C eCommerce merchants across the globe, and enable them to:

•Introduce new audiences to a merchant’s existing customer base

•Boost conversion by removing shoppers’ buying hesitations

•Increase average order value (AOV)

•Open a new stream of income via loan interest

Following its initial success in B2C eCommerce, BNPL is set to be a similar accelerator of B2B commerce and even become a standard payment option for many B2B businesses.

But the benefits of a BNPL solution may be even greater in B2B. Retailers usually purchase offline from their traditional distributors on credit, and this process is done through bookkeeping. Best performing wholesalers gain a competitive advantage over offline local wholesalers by integrating BNPL solutions into their B2B eCommerce platforms.

BNPL enables them to provide larger loans with better terms, and offer new merchants loans based on alternative data underwriting by skipping the lengthy trust process. Even with liquidity limits, credit enhances retailers’ purchasing power and allows them to do more business on the platform.

Given this example, how can wholesale distributors and brands, be assured they have freedom of choice, and integration does not become a barrier to accomplishing their goals?

The game of integration has changed. Hand-coded, lengthy integrations which require deploying a new version release for every new feature are now being replaced with iPaaS or Integration Platform as a Service.

Pre-built integrations do not capture all eCommerce use cases, and there is always a need to add new 3rd party applications to the B2B eCommerce project. However, to be able to rapidly add new extensions without an overhead, B2B distribution and wholesale companies must invest in an e-Commerce solution provider that uses a low-code iPaaS system for integrating data and UI extensions.

Using an iPaaS (which comes as an integral part of the Pepperi B2B Platform) for the Afterpay integration, offered our customer the following key benefits:

• No delays in launching Afterpay for the Australian market

• Cost-effective integration without large up-front investment

• Increased average order value

• Better customer experience

• Stronger customer loyalty

Stay tuned for additional use cases!